Investing in Mohave County Land: Statistics, Market Analysis & Future Predictions

- LYDOS

- Sep 4, 2025

- 9 min read

Here’s a comprehensive, data-driven overview of the vacant-land market in Mohave County, Arizona—covering demand drivers, inventory and pricing ranges, infrastructure catalysts, taxes/carrying costs, zoning/permitting realities, investor strategies, risks, and a forward-looking outlook.

Executive summary - Mohave County Land

Mohave County (home to Lake Havasu City, Bullhead City/Fort Mohave, Kingman/Golden Valley, Meadview/White Hills, and more) is one of the largest, most affordably taxed, and most development-friendly land markets in the Southwest. Population and tourism growth, an aging but steadily expanding retiree base, and major highway investments (the West Kingman I-40/US-93 system interchange and the Rancho Santa Fe interchange) are combining to support long-run demand for residential, recreational, and logistics-adjacent land. Census.govFREDArizona Department of Transportation+2Arizona Department of Transportation+2

At the same time, the county’s size, high share of public land, pockets of water constraint (notably the Hualapai Valley INA), and large distances between utilities mean pricing is highly segmented. Entry-level off-grid acreage can transact for mid-four to low-five figures, while improved city lots near Lake Havasu or river-proximate parcels in Fort Mohave/Bullhead City command multiples of that. Bureau of Land ManagementLandwatch.comZillowRealtor

Below is the deep dive.

1) Where Mohave County sits—size, population, and growth

Scale & geography. Mohave spans ~13,470 sq mi, making it Arizona’s second-largest county by area and among the largest in the U.S. It includes ~150–158 sq mi of water and ~1,000 miles of shoreline along the Colorado River and reservoirs. That sheer footprint underpins abundant rural inventory and diverse micro-markets. azcommerce.comMohave County

Population level & trend. The latest official estimate places the county’s population around 226–228k (2024), up from ~213k in 2020—a steady multi-year climb. The Federal Reserve’s series corroborates the uptrend (2020→2024). Census.govFRED

Age & household profile. Mohave is older than Arizona overall (median age ~53), reflecting a strong retiree component—a persistent driver of low-maintenance lots, RV-friendly communities and small-lot infill in service-rich areas. data.census.govFRED

Takeaway: A very large land base with a growing, older-skewing population creates simultaneous demand for (a) amenity-adjacent, buildable parcels and (b) inexpensive recreational/off-grid acreage.

2) Demand drivers - Mohave County Land

2.1 Retiree & lifestyle migration

Lake Havasu City in particular is a magnet for retirees and outdoor-lifestyle movers, supported by water recreation, events, and lower taxes. Tourism authorities cite ~800–835k annual visitors; third-party retirement coverage highlights affordability and amenities. These flows spill over into demand for nearby residential and resort-adjacent lots. Lake Havasu Citylakehavasucitycommercial.com

2.2 Tourism & short-stay dynamics

State tourism set a new record for overnight domestic visitors in 2024, supporting hospitality and STR-adjacent land uses (e.g., cabin/RV sites). In Lake Havasu, STR data show strong ADR and occupancy, indicating visitor spend that often graduates into second-home or land purchase decisions. Arizona Office of TourismAirbtics | Airbnb Analytics

2.3 Logistics & light industrial proximity

Kingman Airport & Industrial Park—the largest industrial park in rural Arizona—hosts 70–75+ companies and is rail-served (BNSF with an onsite short line). For land investors, this creates demand for nearby workforce housing sites, yard/laydown space, and small industrial pads along I-40/US-93 corridors. Mohave Countychoosekingman.comArizona Department of Transportation

3) Infrastructure catalysts

I-40/US-93 West Kingman System Interchange. Multi-year construction began in 2024 and is expected to open after staged work through 2027, removing a chronic bottleneck and smoothing Phoenix–Las Vegas flows via the US-93 corridor (the backbone of the planned I-11). Better travel times tend to lift land absorption near interchanges and logistics nodes. Arizona Department of Transportation+1

Rancho Santa Fe (Flying Fortress) Interchange (I-40, Kingman). This new interchange opens access to large tracts for commercial and distribution uses; the city anticipates completion in 2026. Parcels with proximity and access improvements typically see faster takedown and premium pricing. Arizona Department of Transportationchoosekingman.com

Ongoing US-93 widenings & I-40 pavement programs. ADOT’s five-year plan invests heavily on US-93 segments toward a four-lane divided highway and on I-40 pavement. Each increment expands the feasible commuter-shed and supports residential subdivision staging. Arizona Department of Transportation+1content.govdelivery.com

Catalyst read-through: These projects reduce friction costs (time, vehicle wear), expand the viable radius for workforce and retirees, and increase the value of parcels with good arterial access.

4) Land supply context (public ownership & entitlement)

Public land share. Roughly 71% of Mohave County is federally managed land (BLM, NPS, etc.). This concentrates private deeded parcels into distinct pockets and corridors—and makes legal access and adjacency a key diligence item. Bureau of Land Managementdownloads.regulations.gov

County GIS & due diligence. Mohave’s GIS map viewer is essential for verifying parcel lines, access, topography, floodplains, and zoning overlays prior to acquisition. Mohave County

Zoning framework. The county’s zoning ordinance (Planning & Zoning Division) governs use, setbacks, and processes (including special uses). Agricultural-residential (A-R) and R-1/R-O residential zones dominate many edge areas; certain agricultural exemptions exist but are specific and conditional. Early entitlement checks reduce holding risk. Mohave County+1mohavecounty-az.elaws.us

5) Inventory & pricing—what’s actually listed

Public portals give a real-time feel for supply and ask-price bands (not closed comps). As of recent snapshots:

Countywide land listings: LandWatch showed ~4,100+ active Mohave land listings. Zillow showed ~2,300+ lots/land entries (varies daily). This underscores abundant inventory but wide quality dispersion (legal access, utility proximity, terrain). Landwatch.comZillow

Submarket snippets: Mohave Valley (river-proximate) had ~80–110 land listings on Realtor/Zillow in a recent check—generally higher asking prices near water or improved subdivisions. Fort Mohave similarly runs dozens of listings with price premiums close to services and the river. Realtor+1Zillow

Typical asking-price bands you’ll see (illustrative from live listings)

Rural off-grid 1–2.5 acres (Yucca/Meadview/White Hills and similar): $4k–$15k is common for raw desert parcels (road access varies). Zillow

Rancho-style 10–20 acres (Hackberry/Kingman outskirts): ~$20k–$60k+ depending on access, terrain, and power proximity. Landwatch.com

Large 36–40 acre tracts (Valle Vista/Kingman plains/White Hills): ~$25k–$75k+ (view corridors and utility distance drive spreads). Landwatch.com

City lots (Lake Havasu City—improved/infill): Often $60k–$150k+, with premiums for larger pads, views, and specific subdivisions. Zillow

River-adjacent lots (Bullhead City/Fort Mohave): Priced higher per square foot when close to the river, golf, or established neighborhoods. Realtor

Note: List prices are not closed sales; always benchmark against recent recorded transactions and line up utilities/permits to understand all-in basis.

6) Housing values & local economics that support land absorption

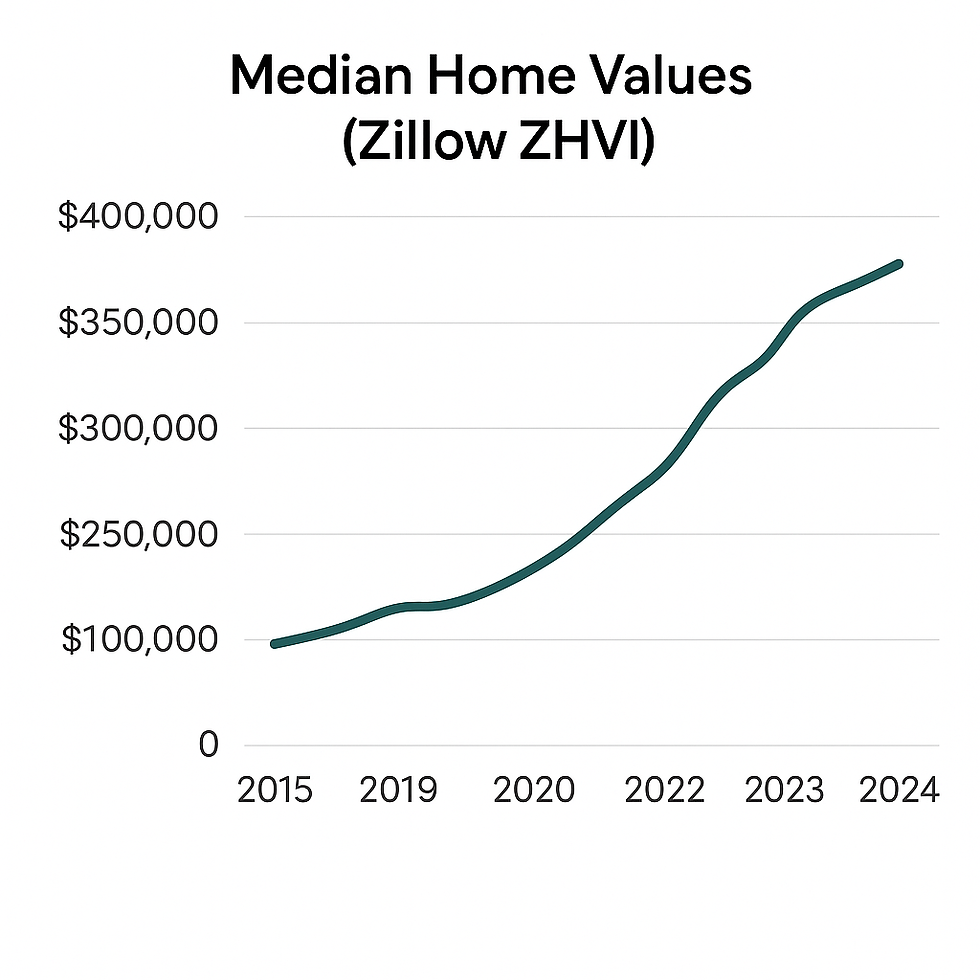

Home values: Zillow’s current ZHVI reads roughly $350k countywide, ~$465k in Lake Havasu City, and ~$270k–$286k across Kingman ZIPs—healthy levels that justify construction on well-located lots once carrying/impact costs pencil. Zillow+4Zillow+4Zillow+4

Incomes & unemployment: Median household income is around $56k (ACS 2023), with recent unemployment running ~4.9–5.1%—in line with a steady regional labor market. data.census.govFRED

7) Carrying costs & transaction frictions (favorable)

Property taxes: Mohave’s effective property-tax burden is low by national standards (roughly 0.44–0.51% effective rate, depending on source and methodology). For land investors, this makes “land-bank” strategies more viable. ownwell.comSmartAsset

No state transfer tax: Arizona does not impose a general real-estate transfer tax, reducing closing friction. (Always confirm any narrow exceptions or local fees.) HomeLightLaw Office of Laura B. Bramnick

8) Water, septic, and permitting—what matters before you close

Septic: If you plan any structure with plumbing on an unsewered parcel, the county requires an approved septic system; Development Services handles permits, inspections, and authorization to discharge. Factor design, soils, and setbacks early. Mohave County+1

Hualapai Valley INA (north of Kingman): Designated in Dec 2022, the INA prohibits expansion of irrigated acreage beyond historical baselines and adds reporting/measurement obligations. While typical residential wells aren’t “irrigation,” the INA signals heightened groundwater stewardship—important for ag-oriented land plays. azwater.gov+1Mohave County

9) Micro-market guide (where, what, and why)

Lake Havasu City & environs (86403/86404/86406)

Who buys: Retirees, second-home owners, STR operators.

Why it works: Amenity-rich, strong tourism, marina/lake access, established utilities.

Land pricing: Infill lots commonly $60k–$150k+; premium for views of the lake and pad-ready sites. Regional home values remain supportive. Lake Havasu CityZillow

Bullhead City / Fort Mohave / Mohave Valley (river corridor)

Who buys: Boating/RV lifestyles, workforce tied to Laughlin casino/hospitality complex, winter visitors.

Why it works: Colorado River recreation, services, proximity to Nevada/California.

Land pricing: Above rural desert; strong for improved lots and planned communities. Realtor

Kingman / Golden Valley / Valle Vista

Who buys: Builders, value-seekers, logistics-adjacent users, SFR and MH developers.

Why it works: Central location at I-40/US-93, industrial park employment base; major interchanges under construction.

Land pricing: Wide spread—from low-five-figure rural tracts to higher values near utilities and arterials. Mohave CountyArizona Department of Transportation

Meadview / White Hills / Dolan Springs (Grand Canyon West & US-93 toward NV)

Who buys: Recreational/off-grid buyers, Las Vegas exurban speculators (future I-11 story), ATV/overland users.

Why it works: Scenic desert, proximity to US-93 to Las Vegas.

Land pricing: Among the most affordable per acre; access and terrain vary widely. Landwatch.com

Yucca / Wikieup corridor

Who buys: Large-acreage seekers; solar/storage prospects evaluate but face transmission/land-use hurdles.

Why it works: Big tracts, improving US-93; desert solitude.

Land pricing: Value bands for 40-acre sections often $25k–$60k+ depending on access and power. Arizona Department of TransportationLandwatch.com

10) Risks and realities to underwrite

Access & title: In a county with high federal and state ownership, ensure recorded legal access (not just two-track “roads”). Pull title reports, easement records, and use the county’s GIS. Bureau of Land ManagementMohave County

Water & groundwater policy: Residential wells are common in rural zones, but ag-scale irrigation is restricted in the Hualapai Valley INA. Track ADWR updates if your business plan includes irrigation, subdividing with shared wells, or high water usage. azwater.gov+1

Utilities & soils: Distance to power, trenching costs, and septic suitability (percolation, setbacks) often dwarf the dirt price. Use pre-application meetings with Development Services. Mohave County

Floodplains/topography: Washes can limit pad locations and increase engineering costs. Confirm FEMA panels and onsite conditions before closing (GIS helps). Mohave County

Market cyclicality: Tourism and interest-rate cycles affect absorption timing. Monitor local employment and state tourism trends. Arizona Office of Tourism

11) Investor strategies that pencil in Mohave County

Amenity-adjacent infill (Lake Havasu & river cities).

Play: Acquire buildable lots near services with clear utility stubs; target MH/park-model friendly zonings or single-family where builders are active.

Why now: Mature amenity base + retiree inflows + relatively high ZHVI supports new construction on well-located dirt. Zillow

Workforce & logistics spillover (Kingman/Golden Valley).

Play: Assemble acreage near the Rancho Santa Fe and West Kingman interchanges for subdivisions, small industrial pads, or yard/laydown.

Why now: Interchanges complete in 2026–2027; airport/industrial park employment base is established and rail-served. choosekingman.comArizona Department of TransportationMohave County

Value rural tracts (Yucca/Meadview/White Hills).

Play: Buy larger tracts at low basis; add value via surveyed access, minor grading/driveway, or well/power feasibility, then sell to recreational users or long-term holders.

Why now: US-93 improvements and Las Vegas proximity create a patient I-11 option value. Arizona Department of Transportation

STR-supportive land (cabins/RV in lake/river influence areas).

Play: Small pad sites, RV/cabin concepts (subject to zoning/permits), aimed at boating and event calendars.

Why now: Documented visitor volumes and STR metrics support seasonal occupancy. Lake Havasu CityAirbtics | Airbnb Analytics

12) Forecast: a constructive, multi-year outlook

Why the bias is positive:

Connectivity jumps: The I-40/US-93 system interchange eliminates a major choke-point; Rancho Santa Fe opens new commercial land; ongoing US-93 four-laning tightens the Phoenix–Vegas corridor. These changes typically re-rate land near ramps and arterials and broaden commuter sheds. Arizona Department of Transportation+1choosekingman.com

Demographics & tourism: An older, growing population plus durable lake/river tourism create consistent underlying demand for small buildable lots and seasonal-use sites. Census.govFREDArizona Office of Tourism

Cost structure: Low property taxes and no state transfer tax reduce drag for land-bank and multi-year entitlement plays. SmartAssetHomeLight

Industrial base: Kingman’s rail-served industrial park, with 70–75+ tenant companies, anchors employment—supporting residential demand and small-bay/yard uses. kingmanairport.comMohave County

What could surprise to the downside: Tightening groundwater policy in specific basins, higher long-term rates, or construction-cost spikes could slow lot take-up rates. That said, Mohave’s low basis, highway leverage, and retiree/second-home demand suggest continued relative strength versus many higher-cost Western markets. azwater.gov

13) Practical checklist before you write an offer

Confirm zoning & use (A-R vs. R-1/R-O, special uses, setbacks). Mohave Countymohavecounty-az.elaws.us

Verify access (recorded easements; no “orphaned” parcels). Use GIS for a first pass. Mohave County

Utilities & septic (distance to power; septic feasibility; any HOA/CC&Rs). Mohave County

Water context (wells; any INA overlap; haul-water logistics). azwater.gov

Flood & terrain (FEMA, washes, slope). Mohave County

Comp & pricing reality (don’t rely solely on list prices; triangulate across portals and recorded sales). Landwatch.comZillow

14) Pricing snapshots by sub-market (illustrative from current listings)

Lake Havasu City: Improved lots often $60k–$150k+ depending on pad, views, and utilities. Zillow

Bullhead City / Fort Mohave: River-adjacent subdivisions demand premiums; a wide spread exists by neighborhood and lot finish. Realtor

Kingman / Golden Valley: City lots and power-proximate acreage price well above raw desert; proximity to Rancho Santa Fe/W. Kingman ramps adds value. choosekingman.com

Meadview / White Hills / Dolan Springs: Some of the county’s lowest per-acre asks, especially for unimproved access tracts; verify roads and terrain. Landwatch.com

Yucca / Wikieup: Large 36–40 acre tracts often mid-$20k to $60k+; access/power drive the spread. Landwatch.com

15) Closing thought

Mohave County pairs big-canvas supply with improving connectivity and low carrying costs. If you prioritize parcels with clear access, sensible utility paths, and suitable zoning, the market offers a spectrum from low-basis recreational holdings to amenity-adjacent infill and logistics-levered plays. Given the 2026–2027 highway timeline, parcels along the I-40/US-93 spine and within Kingman’s growth areas are positioned for outperformance over the next cycle—especially where you can de-risk utilities and entitlement ahead of the curve. Arizona Department of Transportationchoosekingman.com

Sources (select)

Population & age: U.S. Census QuickFacts/ACS; FRED population. Census.govdata.census.govFRED

County size & shoreline: AZ Commerce Authority; Mohave County Econ Dev. azcommerce.comMohave County

Tourism & STR: Lake Havasu CVB facts; AZ Office of Tourism; Airbtics snapshot. Lake Havasu CityArizona Office of TourismAirbtics | Airbnb Analytics

Infrastructure: ADOT project pages and releases (I-40/US-93 West Kingman; Rancho Santa Fe); US-93 widening. Arizona Department of Transportation+3Arizona Department of Transportation+3Arizona Department of Transportation+3

Industrial: City/County economic development; ADOT State Rail Plan. Mohave Countychoosekingman.comArizona Department of Transportation

Property taxes & transfer tax: SmartAsset; Ownwell; AZ legal/practice references. SmartAssetownwell.comHomeLight

Listings (pricing feel): LandWatch; Zillow; Realtor.com. Landwatch.comZillowRealtor

Water policy: ADWR Hualapai Valley INA orders/facts; County workshop materials. azwater.gov+1Mohave County

Comments